Benchmark Asset Allocations

The mix of assets in your portfolio should reflect your investment risk profile.

The following asset allocations have been established by analysing returns over a long period and, as such, can be a used as a strategic benchmark when building your portfolio. These allocations are reviewed and updated annually. All Asset Allocations are in alignment with Select Investor Information booklet dated 30 Sep 2024.

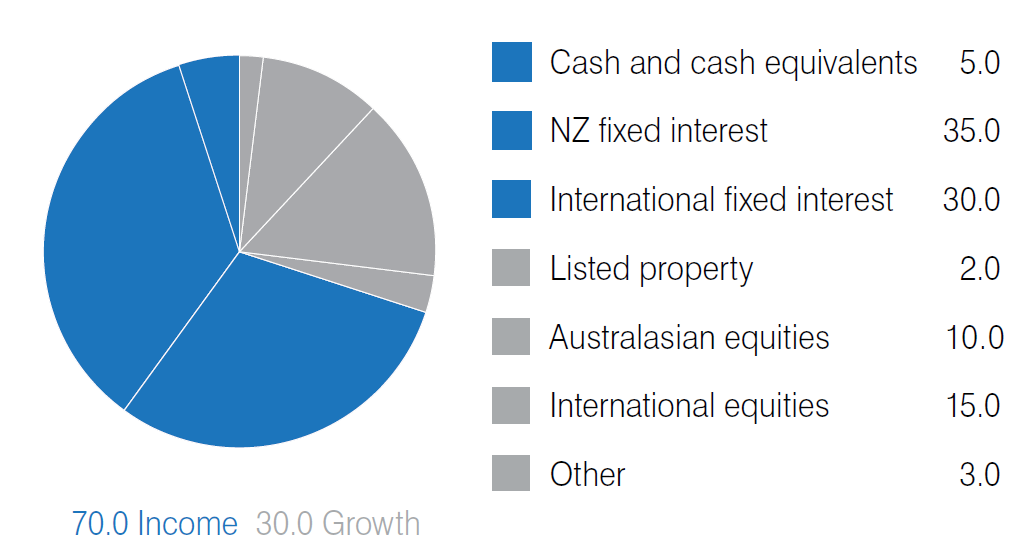

Conservative investor

- You are more comfortable with stable investments and are not willing to accept much risk.

- However, if you have a longer time horizon, you are willing to accept a low to medium level of volatility in your returns over the short term, as long as in the medium term, the value of your capital is preserved.

- You would accept a potential loss in one year out of every four.

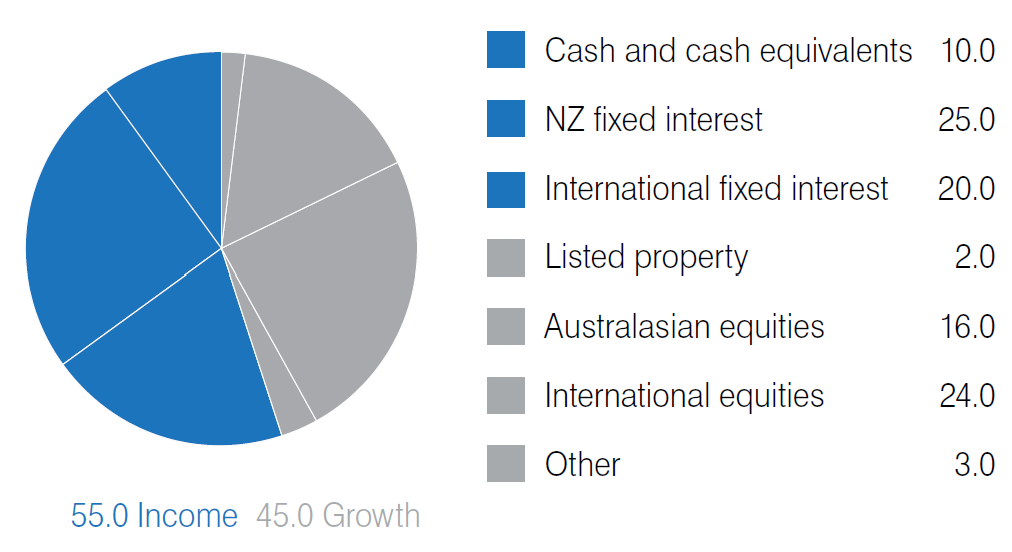

Conservative Balanced Income investor

- You want to protect your capital, see some growth in the medium term and receive some income from distributions along the way.

- You are not comfortable with significant fluctuations in your portfolio, but you understand that some risk is needed to achieve moderate growth over the long term.

- You would accept a potential loss in one year out of every three.

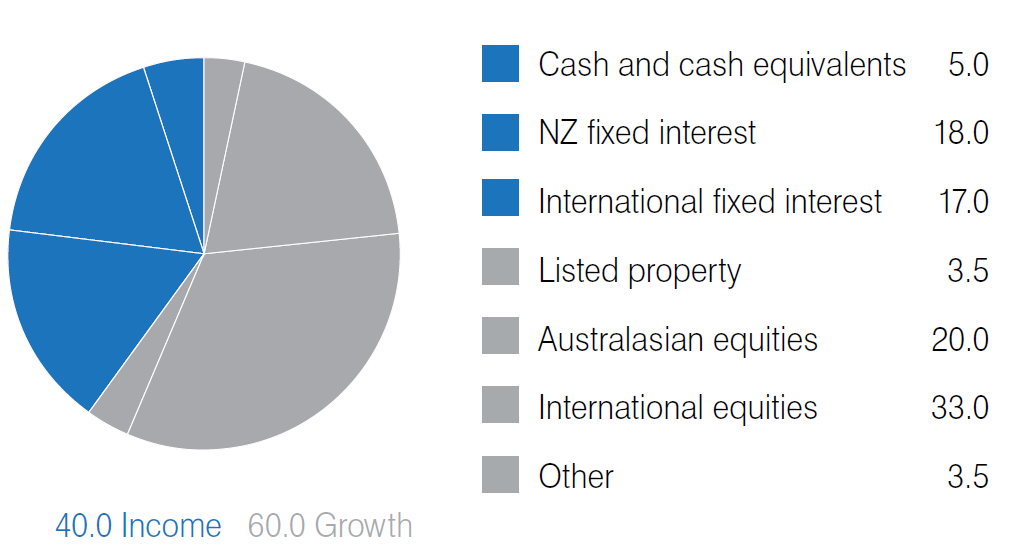

Balanced investor

- You want to protect your capital, but also see some growth in the medium term.

- You are not comfortable with significant fluctuations in your portfolio, but you understand that medium risk is needed to achieve more growth over the long term.

- You would accept a potential loss in one year out of every three.

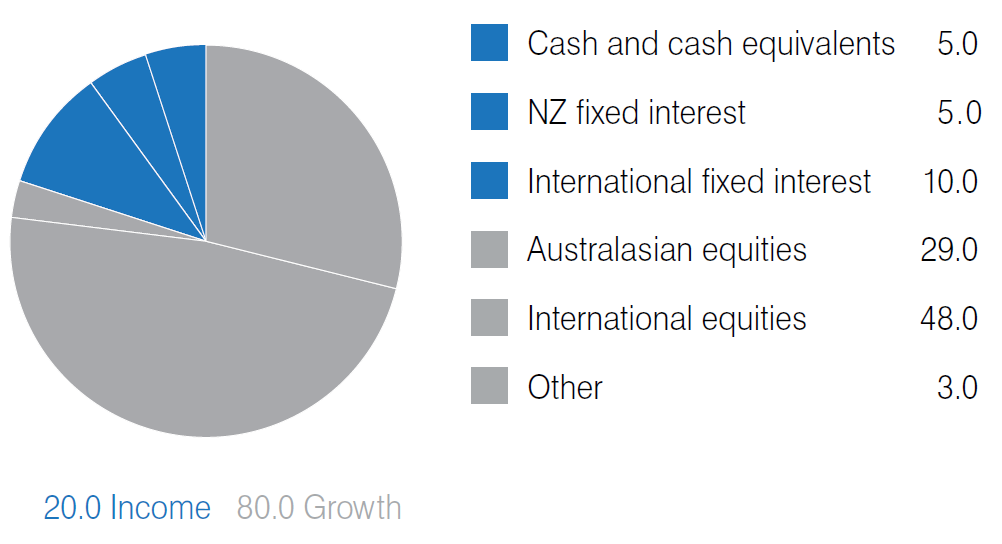

Growth investor

- You have a longer-term timeframe and are comfortable with the medium to high level of risk associated with shares.

- You accept that the value of your investment will fluctuate in the short term if you are seeking higher capital gain in the long term.

- You would accept a potential loss in one year out of every three.

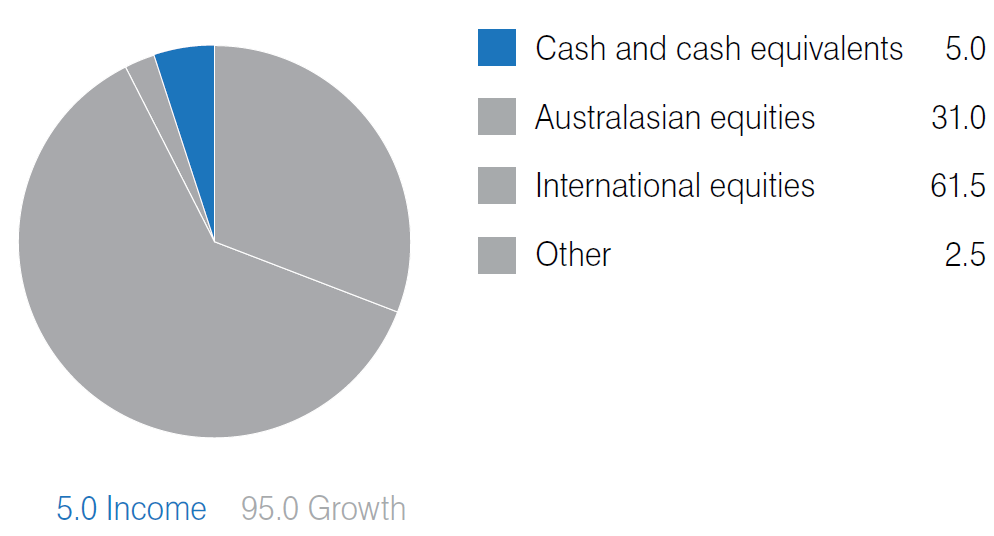

High Growth investor

- You have a long-term timeframe and are comfortable with the high level of risk associated with shares.

- You accept that the value of your investment will fluctuate in the short term if you are seeking higher capital gain in the long term.

- You would accept a potential loss in one year out of every three.

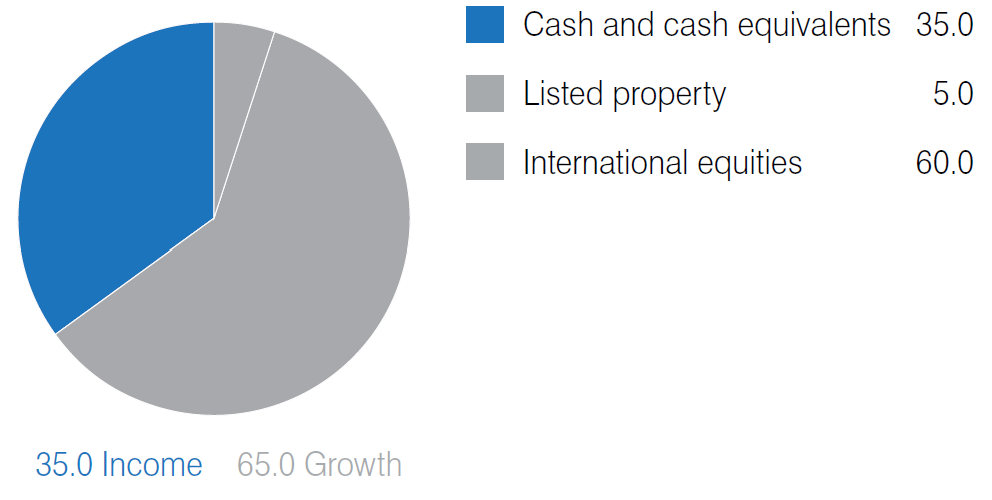

GBP Balanced Growth investor

- You have a longer-term timeframe and are comfortable with the high level of risk associated with shares.

- You accept that the value of your investment will fluctuate in the short term if you are seeking higher capital gain in the long term.

- You would accept a potential loss in one year out of every three.

The long term Strategic Asset Allocations apply to both the Selected and the Selected Responsible Investment portfolios.